what percentage can you earn elsewhere?

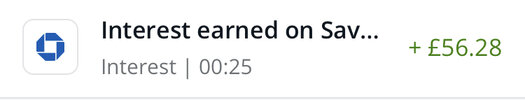

Something like 2.5% in a fixed rate 2 year bond with monthly interest paid out. Giving a reliable £104 p.m. income. Downsides are tying the money up, and not having the elusive chance of a big Premium Bond win.

I was averaging two or three wins, occasionally four, per month on the PBs. I was happy with this. Now nothing for three months.

Last edited: